How a Good Credit Score Can Save You Thousands

Written by: RIC Staff

November 12, 2024

Topics: Good credit can save you costs.

The Money-Saving Power of Good Credit

A high credit score isn’t just a number—it’s a key to financial opportunities and substantial savings.

From low-interest loans to better insurance rates, your credit score has the power to impact nearly every financial decision.

We will break down exactly how a strong credit score can save you thousands of dollars and make your financial life a lot easier.

Unlock Premium Credit Card Perks

With a high credit score, the credit card market opens up with options that provide real rewards. Gone are the days of limited, low-benefit cards.

With good credit, you’re eligible for top-tier rewards cards that offer perks like:

Sign-Up Bonuses: Get cash or points worth hundreds just for opening the card.

High Rewards Rates: Earn more cash back or points on everyday purchases.

0% Intro APRs: Avoid interest on purchases or balance transfers for a set period.

Travel and Purchase Protections: Coverage for your purchases and peace of mind when you travel.

The right credit card can turn routine spending into extra cash in your pocket and secure valuable travel perks.

Those with good credit should take full advantage of these offerings to maximize every dollar spent.

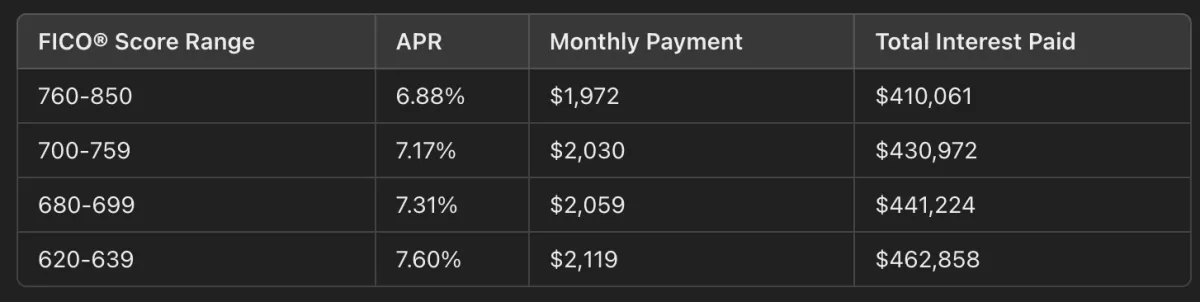

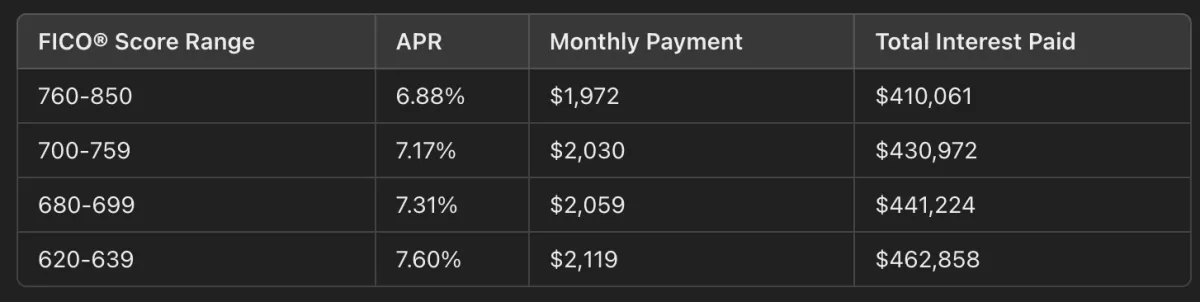

Lower Interest Rates = Big Savings on Loans

Interest rates directly impact the cost of any loan.

For example, with a mortgage, even a slight improvement in interest rate could save you thousands.

Here’s a quick comparison for a $300,000 30-year mortgage:

Slash Your Auto Insurance Premiums

Yes, your credit score can also determine how much you pay for car insurance. Many insurers view high credit as a sign of lower risk and reward you with cheaper rates.

Here’s a look at average auto insurance costs:

National average: $3,017

Drivers with excellent credit: $1,947

Drivers with poor credit: $4,145

This means having excellent credit can save you over $2,000 annually on auto insurance alone. Over several years, those savings will add up fast.

Better Approval Rates on Loans and Rentals

Good credit doesn’t just save you money—it opens doors, hopes, and better chances to a business, access to capital, and higher approval rates.

Whether you’re applying for a personal loan or trying to secure a rental property, high credit improves your chances of approval and reduces the hoops you’ll need to jump through.

This can mean lower security deposits, more favorable loan terms, and an easier path to reaching your financial goals.

The Simple Steps to Get and Maintain a High Credit Score

Achieving a high credit score takes time, but the payoff is well worth it.

Here are the basics:

Monitor Your Score Regularly to stay on top of changes and address any unexpected dips.

Use Credit Responsibly: Keep your balances under 30% of your credit limit.

Pay On Time, Every Time: Consistent, timely payments are the bedrock of a good credit score.

Review Your Credit Report Annually or even monthly: Spot and fix any errors before they impact your score.

High Credit Equals High Savings

A great credit score does more than boost your financial reputation—it’s a money-saving tool that offers real, lasting benefits.

Whether you’re interested in saving on loans, snagging lower insurance premiums, or simply having better access to financial opportunities, investing in your credit is one of the smartest financial moves you can make.

Get Your Complimentary Session With A Credit Expert Today.

The Money-Saving Power of Good Credit

A high credit score isn’t just a number—it’s a key to financial opportunities and substantial savings.

From low-interest loans to better insurance rates, your credit score has the power to impact nearly every financial decision.

We will break down exactly how a strong credit score can save you thousands of dollars and make your financial life a lot easier.

Unlock Premium Credit Card Perks

With a high credit score, the credit card market opens up with options that provide real rewards. Gone are the days of limited, low-benefit cards.

With good credit, you’re eligible for top-tier rewards cards that offer perks like:

Sign-Up Bonuses: Get cash or points worth hundreds just for opening the card.

High Rewards Rates: Earn more cash back or points on everyday purchases.

0% Intro APRs: Avoid interest on purchases or balance transfers for a set period.

Travel and Purchase Protections: Coverage for your purchases and peace of mind when you travel.

The right credit card can turn routine spending into extra cash in your pocket and secure valuable travel perks. T

hose with good credit should take full advantage of these offerings to maximize every dollar spent.

Lower Interest Rates = Big Savings on Loans

Interest rates directly impact the cost of any loan.

For example, with a mortgage, even a slight improvement in interest rate could save you thousands.

Here’s a quick comparison for a $300,000 30-year mortgage:

Slash Your Auto Insurance Premiums

Yes, your credit score can also determine how much you pay for car insurance. Many insurers view high credit as a sign of lower risk and reward you with cheaper rates.

Here’s a look at average auto insurance costs:

National average: $3,017

Drivers with excellent credit: $1,947

Drivers with poor credit: $4,145

This means having excellent credit can save you over $2,000 annually on auto insurance alone. Over several years, those savings will add up fast.

Better Approval Rates on Loans and Rentals

Good credit doesn’t just save you money—it opens doors, hopes, and better chances to a business, access to capital, and higher approval rates.

Whether you’re applying for a personal loan or trying to secure a rental property, high credit improves your chances of approval and reduces the hoops you’ll need to jump through.

This can mean lower security deposits, more favorable loan terms, and an easier path to reaching your financial goals.

The Simple Steps to Get and Maintain a High Credit Score

Achieving a high credit score takes time, but the payoff is well worth it.

Here are the basics:

Monitor Your Score Regularly to stay on top of changes and address any unexpected dips.

Use Credit Responsibly: Keep your balances under 30% of your credit limit.

Pay On Time, Every Time: Consistent, timely payments are the bedrock of a good credit score.

Review Your Credit Report Annually or even monthly: Spot and fix any errors before they impact your score.

High Credit Equals High Savings

A great credit score does more than boost your financial reputation—it’s a money-saving tool that offers real, lasting benefits.

Whether you’re interested in saving on loans, snagging lower insurance premiums, or simply having better access to financial opportunities, investing in your credit is one of the smartest financial moves you can make.

Get Your Complimentary Session With A Credit Expert Today.